Airtm: A P2P Solution for Hyperinflation Ravaged Venezuela

How Did a Country Poised for Growth Get Here?

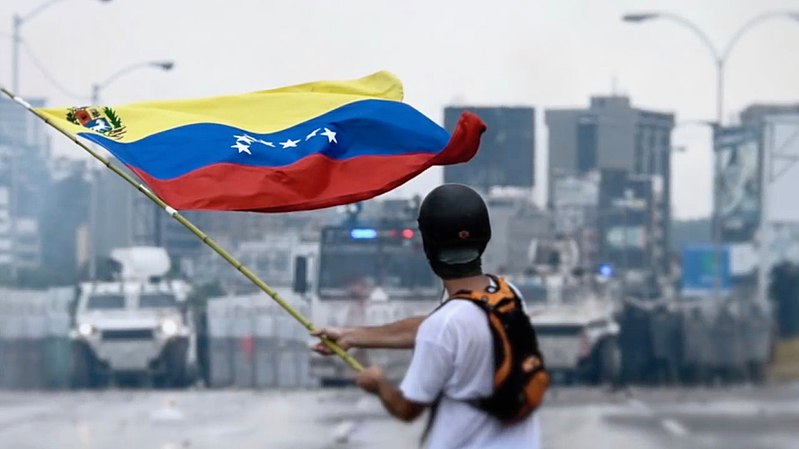

https://commons.wikimedia.org/wiki/File:2017_Venezuelan_protests_flag.jpg

https://commons.wikimedia.org/wiki/File:2017_Venezuelan_protests_flag.jpg

In the 1950s, Venezuela was the wealthiest country in Latin America thanks to it having the world’s largest oil reserves. However, this is no longer the case. Venezuela’s economic degradation is a consequence of corruption and mismanagement by the political elite which has drastically altered the country’s narrative. A decline in oil production, starting in 2007, was a consequence of U.S sanctions and inexperience amongst the Chavez loyalists that were running the Petróleos de Venezuela, S.A. (PDVSA). To make matters worse, the government used the revenues from the 2004-2012 oil boom to boost imports rather than invest and enhance the productive capacity of the future.

The government countered the impending economic slowdown by printing more money in order to finance a large budget deficit. However, hyperinflation ensued, thereby eroding purchasing power and causing a hoarding of goods as firms and individuals anticipated further price increases. Nationalization under Chavez permitted the expropriation of agricultural land. This destroyed Venezuela’s agricultural capacity. Shortages and price increases for all basic necessities emerged.

Venezuela’s economic meltdown and its enduring misguided economic policies likely mean the country is facing years of malaise. GDP contraction and hyperinflation continue to hamper Venezuela’s external position as foreign funding has dried up. Additionally, a lack of economic data by Venezuela’s central bank makes inflation extremely difficult to predict for Venezuelans. Imports have collapsed as citizens are unable to afford bare necessities like food and medicine. Similarly, poverty increased from 48% in 2014 to 91% in 2017.

The world’s largest petro state is supported exclusively by its vast oil reserves, which top the likes of Saudi Arabia, Iran and Russia. Oil is the lifeline of Venezuela’s economic well-being, accounting for 98% of its export earnings and a significant proportion of its GDP. However, the 2017 U.S. sanctions on its state-run oil company have hurt oil operations and halved oil production from 3.5 million to 1.2m barrels per day. This has left the country in turmoil given that the value of money has eroded at an unprecedented level with little in the way of answers.

Initial Coin Offering: Nothing More than Smoke and Mirrors

In August 2018, President Maduro announced an initial coin offering (ICO) of an oil-backed “petro” digital currency called the “sovereign bolivar.” An ICO is the cryptocurrency equivalent to an IPO in the investment space – whereby firms raise capital from individual investors in order to facilitate their growth. The “sovereign bolivar” is backed by Venezuela’s oil reserves and aims to secure cash in the face of hyperinflation while also avoiding U.S. sanctions. Its goal was to establish a single floating exchange rate from the domestic currency to the digital currency. In practice, the launch of the fiat currency seems useless considering the inflation rate has exceeded 117,681% as of January 10th, 2019. This means that the minimum salary which previously covered 2000 daily calories, now buys 600.

Furthermore, the currency cannot be traded and has no backing from parliament – which has said it is illegal. Without a corresponding policy change, economists such as Steve Hanke, a hyperinflation expert and professor of applied economics at John Hopkins University, view the ICO as a scam and an illegal means of mortgaging the country’s oil reserves. Additionally, cryptocurrencies like the “sovereign bolivar” are highly risky as units of account. Large changes in demand, in conjunction with a fluctuating supply, create the conditions necessary for extreme price volatility.

Airdrop Venezuela Project

Peer-to-peer platforms have the potential to transform non-currency cryptos into real money and subsequently increase the demand for cryptos. As it stands, those who earn in Bolivar have zero incentive to save – even for short term reasons. Instead, purchasing goods immediately is the only viable option for citizens as inflation is highly sporadic.

Airtm is a Mexican-based blockchain-powered currency platform with the potential to change this. The firm aims to attract financial aid to millions of deprived Venezuelans through a project named Airdrop Venezuela. Its immediate goal is to attract cryptocurrency donations such as Ripple, Litecoin and Bitcoin and distribute $1 million to the most impoverished citizens.

The project serves two purposes. First, the electronic trading platform matches buyers and sellers in free exchange so that citizens can convert their bolivar to dollars and vice versa. As usage rates over the cloud-based system increase, more and more Venezuelans will be prompted to use U.S. dollars. This is a powerful illustration of using technology to overcome economic plight. It is fast, practical and it provides a hedge against currency volatility.

Secondly, it bypasses the need to distribute liquid cash through armoured trucks which are prone to hijacking. Venezuela’s government is unwilling to heed to the humanitarian crisis, which is plaguing the country. Failure to allow private access to foreign exchange into the country means that free trading of the Bolivar at market rates is not aligned with the government’s socialist ideals.

This is where Airtm can act as an innovative solution to political barriers. Successful distribution of the $1mn target would encourage Venezuelans to use U.S. dollars in day-to-day transactions. Despite anti-American sentiment amongst Maduro’s government, thereby helping to stop the economy from collapsing further. As a parallel, Zimbabwe’s infamous hyperinflation crisis induced a dollarization campaign whereby the population used U.S. dollars rather than the Zimbabwe dollar, which was essentially worthless. Accordingly, Zimbabwe’s economy returned to stability.

Where Does the Narrative Go from Here?

Airtm appears to be a potential solution for the country’s financial crisis. In the short term, Venezuela’s cycle of hyperinflation needs to be curtailed. Based on successful dollarization in many countries, the U.S. dollar could fit this purpose by allowing Venezuelans to save money rather than to live week by week on a worthless currency. It is inevitable that U.S. sanctions on PDVZA will make it increasingly difficult for the Maduro government to fund itself and will prompt the military to defeat. Therefore, until Venezuela adopts a new regime along with dollarization, the bolivar will inevitably face further hyperinflation.

In the long term, however, real change needs to come from the central bank in the form of allowing foreign businesses to operate in the country. As the most obvious course of action, Venezuela needs to diversify away from oil and invest in alternatives such as solar or wind energy. Otherwise, it will remain the archetype of a petrostate and faces a cycle of boom and bust based on speculation and trading, rather than on the productive capacity of its industry.