Can Renewable Energy Reconstruct Middle Eastern Geopolitics?

The increasing availability of clean energy sources and their recent cost competitiveness with fossil fuels in the energy market have added new perspectives to the discussion on sustainability. In the past, talks have revolved around the urgency of climate change and global warming; highlighting the cruciality of environmental awareness. Previously, any geopolitical analysis revolved around fossil fuels; now, things have changed.

On January 14, at the International Renewable Energy Agency’s (IRENA) assembly in Abu Dhabi, the geopolitical impacts of renewable energy sources overtaking the use of fossil fuels were discussed for the first time. The organization recently launched the ‘Global Commission on the Geopolitics of Energy Transformation’, which will look at the strategic role of renewables, and their impact on trade and cooperation dynamics. This isn’t without reason; IRENA’s most recent report predicted how in just two years, all renewable energy sources will be cheaper than fossil fuels. Onshore wind and solar photovoltaic energy have already reached this undercutting level, and are expected to reach $0.03kW/h by 2020, which is significantly below the price of fossil fuels. The cheaper that these clean sources become, the easier and more likely it is for consumers to invest in infrastructure to support them.

While this is excellent news for environmentalists, it may be difficult for diplomats and foreign policy analysts to acclimate to. Since the Industrial Revolution, fossil fuels have dominated the international political and economic landscape; driving both cooperation and conflict, growth and loss. Emerging clean energy technologies and their low costs could potentially shift the balance of power in both international and regional systems, and could also alter the strategic interests of states. These effects will be felt especially in Arab oil-exporting countries, where revenue from vast crude oil reserves accounts for an average of 77% of total fiscal revenue, and consequentially where one of the world’s largest concentrations of natural gas is found. As oil prices continue to surge, hitting $70/barrel compared to $55/barrel just three months ago, companies of countries in the ME continue to sway towards implementing the less expensive renewable sources.

At Abu Dhabi Sustainability Week (ADSW) from January 13-17, Saudi Arabia’s eminent oil and gas company, Aramco, along with a number of other Saudi energy companies, showcased a number of innovations and technologies through exhibitions, presentations, and panel discussions. The emphasis on environmental sustainability came as part of the Saudi Vision 2030, as diversifying the economy is hoped to bolster long-term investment. According to OPEC, the oil and gas sector in Saudi Arabia makes up about 85% of total revenue, and 50% of the GDP. Due to this economic homogeneity, there is a heavy reliance on the oil market and its fluctuating prices. This drives away investors, who want stability and predictability. Combined with low population growth rates and rising unemployment, the pressure to regulate the Saudi economy is reinforced. Hence, the country also announced its ambitious plans for 2018; to allocate at least $7 billion towards renewable energy projects, with a focus on harnessing solar potential. Conjointly, other energy giants in the Middle East, like the UAE and Qatar, are expected to expand their solar shares three-fold by 2035.

Globally, non-oil producing countries are following suit, enlarging their targets for clean energy use. For instance, lawmakers in the European Union have adjusted their renewable energy target to a binding 35% of total energy use, after the 30% non-binding target of last year. The Dutch parliament recently joined Norway in planning a ban on the sale of new diesel and gas cars. The French government also plans to eliminate fossil-fuelled vehicles by 2040.

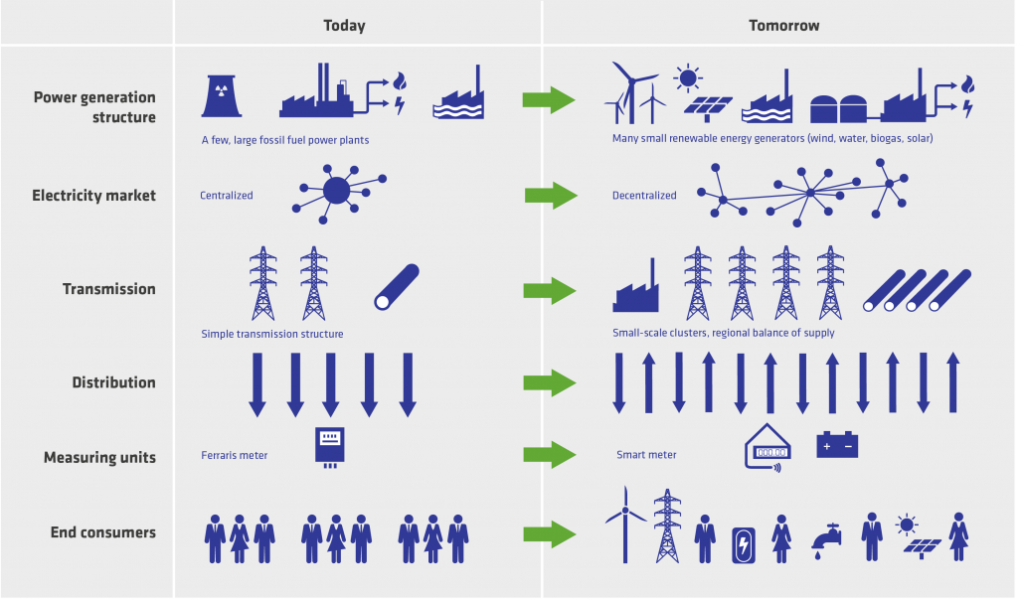

Often overlooked is what this means for grid efficiency in current energy systems. Looking at Middle Eastern energy economies, the conversion of a fossil fuel based system to one that integrates renewables will demand a greater amount of smaller, decentralized power plants instead of a few centralized power hubs. These are also referred to as “on-site renewables” or “micro-generators”, as they are close to, or directly connected to the consumer building or community. Updating the existing oil and gas networks to accommodate the growth of on-site renewables will place a significant burden on policymakers.

In relation, digitalization is an applicable aspect of energy decentralization and efficiency which could challenge current trade systems and cooperation. Clean energy technologies help to develop Internet-connected devices, which simultaneously enable proliferating data generation. Beneficial as it may seem, digitalization will not only intensify the need for policy and regulatory changes concerning energy grids but will also demand larger investments in cyber-security. The transition to renewables will also require a much greater scale of measurement and control of peripheral units being incorporated into the energy system.

While it seems plausible for a major oil economy like Saudi Arabia, other Middle Eastern states may face numerous economic challenges that could limit their ability to put innovations into effect. In Qatar, as an example, political triage may not favour a renewable energy program after some of its critical importers have severed all ties. Now, with a commitment to create infrastructure for the 2022 World Cup, Qatar is deep in a crisis that diverts attention needed for a sound energy system transition. Also looking at the United Arab Emirates’ plan to invest $163 billion in renewables and have them account for 44% of total energy needs by 2050, there’s a chance that these extraordinary bids were just meant for the headlines and improving public image.

Wolf Grossman, a professor at the Wegener Centre for Climate and Global Change, and his colleagues, have suggested that in regions where decentralization is starting to be incorporated, states should be inclined to cooperate in the form of interconnected energy networks. For example, if this was to play out in North America, energy plants in the United States could be used to power Canadian or Mexican cities. This would require a deep intergovernmental understanding and trust.

Through both contemporary political events and historical differences, the likelihood of an interconnected renewable energy system looks bleak in the Middle East. In addition to the Qatar crisis, the Yemen civil war has aggravated regional power struggles and fragmentation, as Saudi-aligned forces supporting the exiled government are pinned against the Iranian-backed Houthi rebels. Regardless, existing inter-regional trade accounts for very little of countries’ total exports and imports, making it inconceivable that they would try to collectively balance their wind and solar generation. These states have become dependent on the international oil and gas market to the point where in a 100% renewable world, they could very well collapse.

Currently, domestic revenues on average account for only 10% of total GDPs. It’s an age-old concern; the Dubai’s Sheikh Rashid remarked how “[his] grandfather rode a camel, [his] father rode a camel, [he drives] a Mercedes, [his] son drives a Land Rover, his [grand]son will drive a Land Rover, but his [grandson’s] son will ride a camel”, reflecting on sustainability of the reliance on oil.

Working towards a sustainable future thus implies questions as to what degree regional tensions will augment. Oil producing states are now starting to pivot away from their fossil-fuelled roots in order to be future leaders in renewable energy, as seen in any headlines concerning events at the ADSW. There seems to be an underlying fear of imminent instability that is driving states to pursue considerable expansion in clean energy. Saudi crown prince Mohammed bin Salman described how the country has “developed a case of oil addiction” and that his vision will ensure that “by 2020, if oil stops [they] can survive”. Rising competition of oil supplies from the Americas and Africa, plus an end of the ban on U.S exports, sheds a defensive light on Middle Eastern clean energy goals.

By and large, IRENA’s commission on geopolitics will play a crucial role in determining how such changing dynamics will affect security, independence, and stability. Even if outcomes further isolate states, or end up fostering regional alliances, there’s no doubt that the Middle East’s oligopoly on oil is diminishing in the face of cheap renewables, and will require deep reconstructing of both political and economic systems.

Edited by Sarie Khalid